Energy Storage Project Electricity Price Settlement

A 2025 Update on Utility-Scale Energy Storage Procurements

Changes in trade and tax policy may increase costs and put a damper on near-term forecasted energy storage projects. On February 4, 2025, an additional 10% tariff on all goods

A Market Mechanism for a Two-stage Settlement Electricity

More specifically, we propose a constrained energy bid for storage in the real-time market, such that the storage physical characteristics, e.g., storage degradation function, remain the same.

Pennsylvania PJM settlement might slow price hikes, but green energy

The post Pennsylvania PJM settlement might slow price hikes, but green energy projects still wait to connect to the grid appeared first on PublicSource. PublicSource is a nonprofit news

FPL rate settlement reduces request by nearly a third, limits

JUNO BEACH, Fla., Aug. 20, 2025 / PRNewswire / -- Florida Power & Light Company and 10 key stakeholder groups filed a comprehensive four-year rate settlement agreement with state

2022 Grid Energy Storage Technology Cost and Performance

The 2022 Cost and Performance Assessment provides the levelized cost of storage (LCOS). The two metrics determine the average price that a unit of energy output would need to be sold at

New York''s Bulk Energy Storage Procurements to Commence in

New York State continues to advance its bulk energy storage deployment efforts, and a final Bulk Storage Implementation Plan is now likely to be made public before the end of

What electricity price does the energy storage project implement

The pricing of electricity within energy storage projects is not merely a numerical value; it embodies a confluence of factors that shape the energy landscape. With a multi

Impact of Energy Storage on Electricity Prices

This article provides an in-depth analysis of how energy storage impacts electricity pricing models, potential cost savings, and overall market dynamics, while emphasizing the role of Business

PJM settlement could lower prices; green projects anticipate grid

Following these developments, PJM agreed to a settlement that imposed price caps on upcoming capacity auctions through 2027—a decision that could potentially stabilize prices

Japan scales up batteries but companies worry rule changes may

3 days ago· Investors are pouring billions of dollars into Japan''s nascent electricity storage market as power demand is growing after a long decline, but changes proposed to smooth the

Potential Arbitrage Revenue of Energy Storage Systems in PJM

We determined minimum potential revenue with a similar analysis of the day-ahead market. We presented the distribution over the set of nodes and years of price, price volatility, and

Impact and Benefits of 5MS on the Australian Utilities Market

Overview This IDC Perspective explores one of the largest transformation programs in the global energy industry. The Five-Minute Settlement (5MS) program delivered by the Australian

6 FAQs about [Energy Storage Project Electricity Price Settlement]

Are energy storage prices a threat to energy storage owners?

Risk analysis By analyzing the cumulative profit curves and daily profit distributions, we observe that when predicted prices are utilized, many instances result in negative profits, posing a potential threat to energy storage owners. Ideally, we aim for results that closely resemble the scenarios with perfect forecasts.

Can storage entities participate in arbitrage in wholesale electricity markets?

Storage entities in wholesale electricity markets can participate in arbitrage by charging during periods of low prices and discharging during periods of high prices, thereby maximizing their profits. To evaluate potential profits, various models have been introduced in the literature, including price taker and strategic-behavior models .

How does a hedge provider pay for a power plant?

The hedge provider pays the "strike price" per megawatt hour of power purchased. The strike price is equal to the market fuel price multiplied by an assumed heat rate, plus a fixed O&M charge per megawatt hour. The hedge provider also pays for assumed start-up costs for the plant.

Which energy storage technologies are included in the 2020 cost and performance assessment?

The 2020 Cost and Performance Assessment provided installed costs for six energy storage technologies: lithium-ion (Li-ion) batteries, lead-acid batteries, vanadium redox flow batteries, pumped storage hydro, compressed-air energy storage, and hydrogen energy storage.

What is a revenue generation strategy for a utility-scale battery project?

There are several revenue generation strategies for utility-scale battery projects, including pricing arbitrage (buying energy at low prices and selling at high prices), sales of capacity or ancillary services, or sales of demand response and transmission-related services. In organized markets, merchant sales expose projects to market price risk.

How can a battery storage project manage price risks?

Many market participants are trying to develop other products to help battery storage projects manage price risks. Clearing prices in transactions with projects from other asset classes — for example, thermal, wind and solar — should play a central role in the attractiveness of these products to the power marketers likely to transact with projects.

More industry information

- Irish Grid Energy Storage Solution Brand

- Australia Huijue Energy Storage Products

- User Energy Storage System Solution

- Grid-connected string inverter

- Outdoor Power Equipment Ranking

- Tunisian mobile energy storage system manufacturer

- Gabon inverter converted to 12v

- Outdoor battery cabinet 730kwh

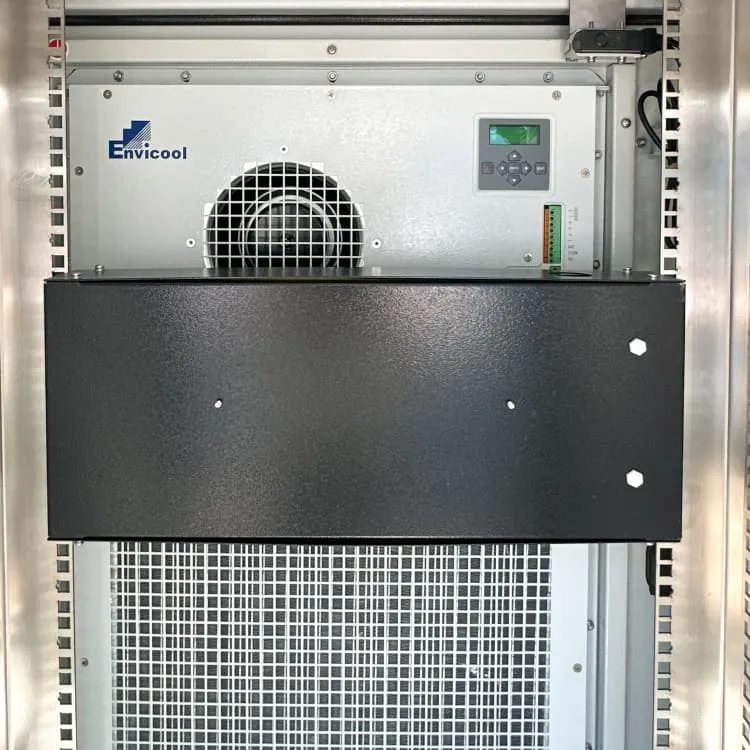

- What supporting facilities are available for energy storage projects

- Is a 1 kilowatt photovoltaic panel enough for home use

- Somalia lithium iron phosphate battery pack

- North Asia Photovoltaic Inverter Specifications

- Portugal wind solar storage and transmission by 2025

- New energy battery cabinet with base station power generation

- Energy storage charging pile flywheel

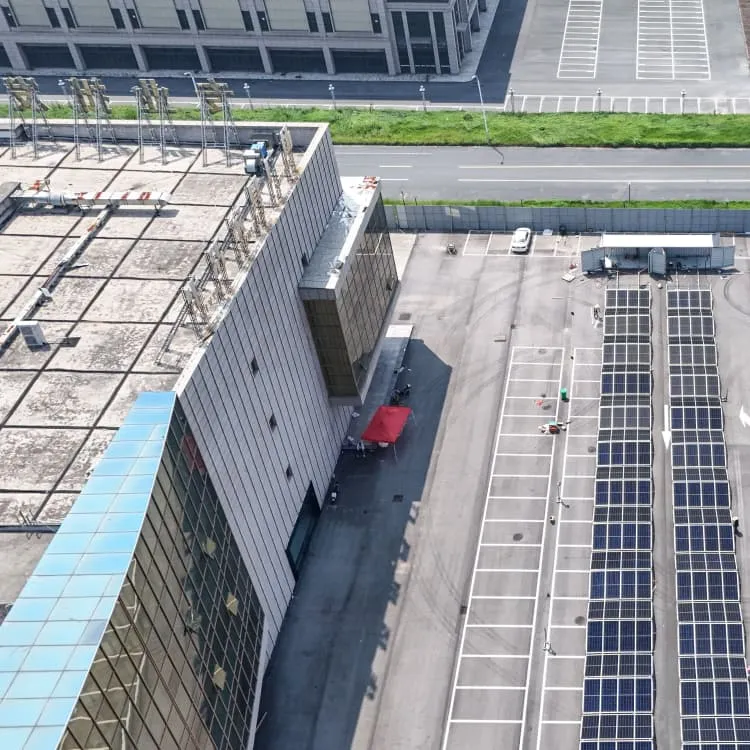

- Algeria photovoltaic off-grid energy storage

- Palau solar energy storage lithium battery

- 12v 700w multi-function inverter

- The greater the inverter power the

- Taboo for mobile outdoor power supply

- Photovoltaic AGC and energy storage AGC

- What is the price of polycrystalline photovoltaic panels in Angola

- Select a large photovoltaic inverter

- What is the relationship between photovoltaics and solar panels

- Luxembourg photovoltaic energy storage battery

- Angola 220v portable power supply manufacturer

- Solar Photovoltaic Panel Related