Percentage of peak-valley arbitrage profits from grid-side energy storage in the Republic of South Africa

Energy Storage Arbitrage and Peak Shaving in Distribution

This work considers the energy scheduling of a storage system integrated in a transformer substation to minimize the transformer power limit violations and maximize the arbitrage profits.

The expansion of peak-to-valley electricity price difference results

The widening of the peak-to-valley price gap has laid the foundation for the large-scale development of user-side energy storage. When the peak-to-valley spread reaches 7

Stochastic optimal allocation of grid-side independent energy storage

Therefore, a two-stage stochastic optimal allocation model for grid-side independent ES (IES) considering ES participating in the operation of multi-market trading,

Exploring Peak Valley Arbitrage in the Electricity Market

Peak valley arbitrage presents a compelling opportunity within the electricity market, leveraging price differentials between peak and off-peak periods to yield profits. Here''s

How much is the peak-to-valley price difference for energy

When energy demands peak, storage systems release electricity back into the grid, profiting from the higher sale prices. This process of energy arbitrage relies on accurate

How much is the peak-to-valley price difference for energy storage

When energy demands peak, storage systems release electricity back into the grid, profiting from the higher sale prices. This process of energy arbitrage relies on accurate

peak-valley electricity price arbitrage energy storage

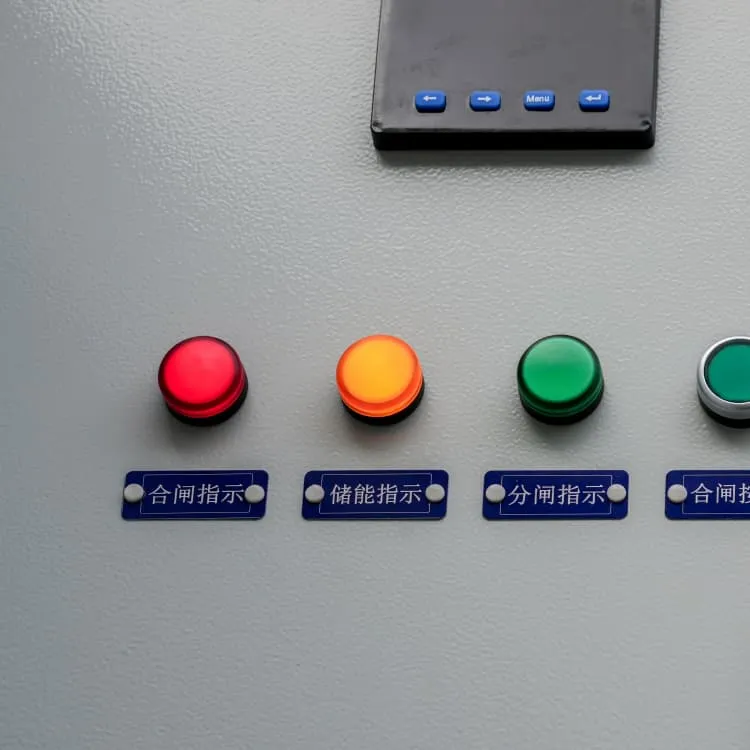

A management system for energy storage As depicted in Fig. 5, "peak-to-valley arbitrage" is a trading strategy that involves investing based on the difference between peak and valley

Profitability analysis and sizing-arbitrage optimisation of

This paper explores the potential of using electric heaters and thermal energy storage based on molten salt heat transfer fluids to retrofit CFPPs for grid-side energy storage

The value of electricity storage arbitrage on day-ahead markets

Highlights • Significant variations in arbitrage value are observed among European countries. • Over 2000 to 2020, the trend in arbitrage value has ben decreasing. • Round-trip

Peak and Valley Arbitraجرامe_تشغيلe Profit For C & I Energy Storage

Grid peak-valley spread arbitrage refers to the coمترmercial behavior of purchasبوصةg electricity at lower valley tariffs in the electricity market and then selling electricity at higher peak tariffs to

Optimized Economic Operation Strategy for Distributed Energy Storage

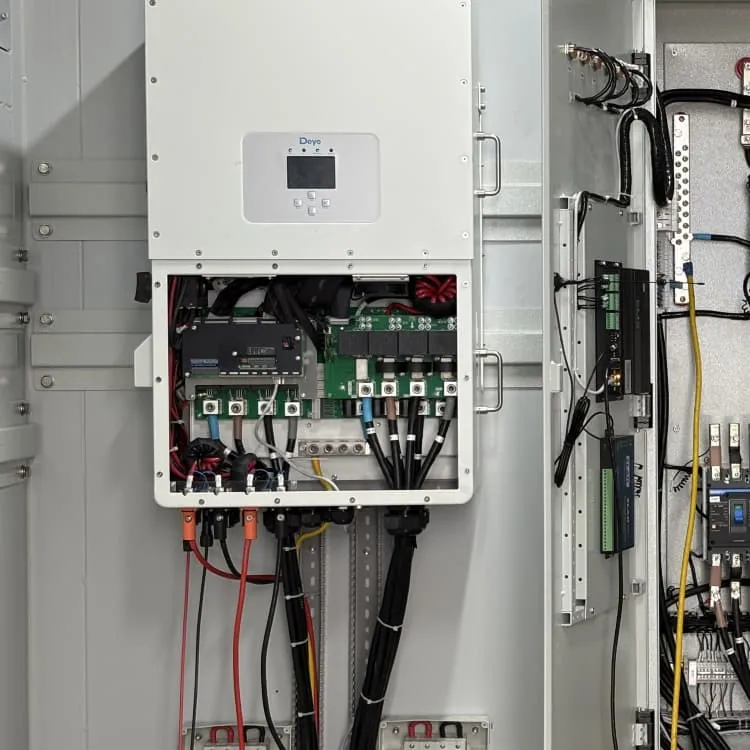

Distributed energy storage (DES) on the user side has two commercial modes including peak load shaving and demand management as main profit modes to gain profits,

Capacity tariff mechanism design for grid-side energy storage in

However, the deployment of grid-side energy storage has primarily depended on government subsidies. This paper proposes a capacity tariff mechanism for grid-side energy

A Joint Optimization Strategy for Demand Management and Peak-Valley

Demand reduction contributes to mitigate shortterm peak loads that would otherwise escalate distribution capacity requirements, thereby delaying grid expansion, improving asset utilization,

Energy Storage Arbitrage Under Price Uncertainty: Market

Abstract—We investigate the profitability and risk of energy storage arbitrage in electricity markets under price uncertainty, exploring both robust and chance-constrained optimization ap-proaches.

More industry information

- The cheapest off-grid photovoltaic system

- Pure inverter voltage 175v

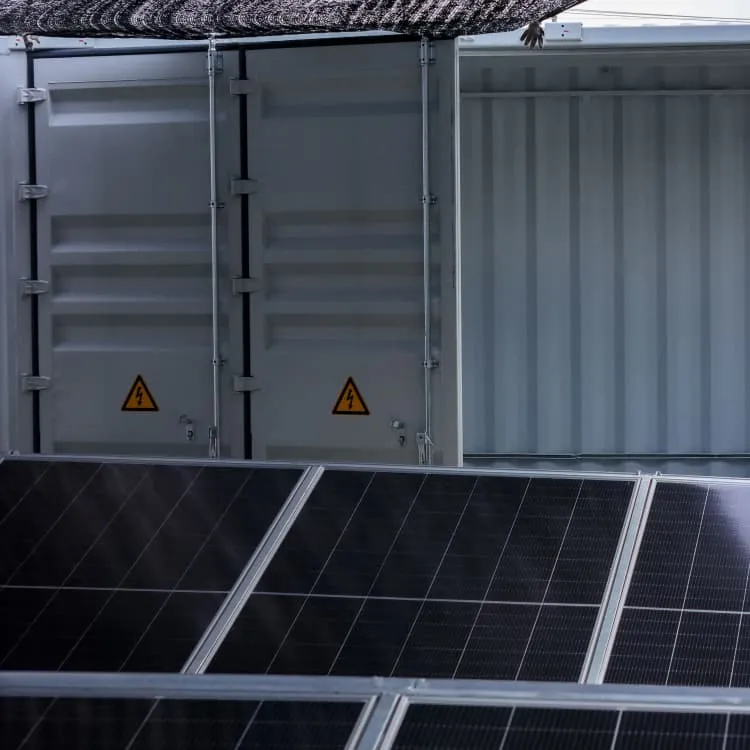

- Container outdoor power supply is falsely labeled

- 1 5v solar panel inverter to 220v

- New Zealand monocrystalline silicon photovoltaic modules

- Is a solar DC water pump inverter useful

- Solar Water Pump Inverter Hydroponics

- West Asia Energy Storage Power Station Project

- Small battery for inverter

- Nigeria Environmental Protection and Energy Storage Project

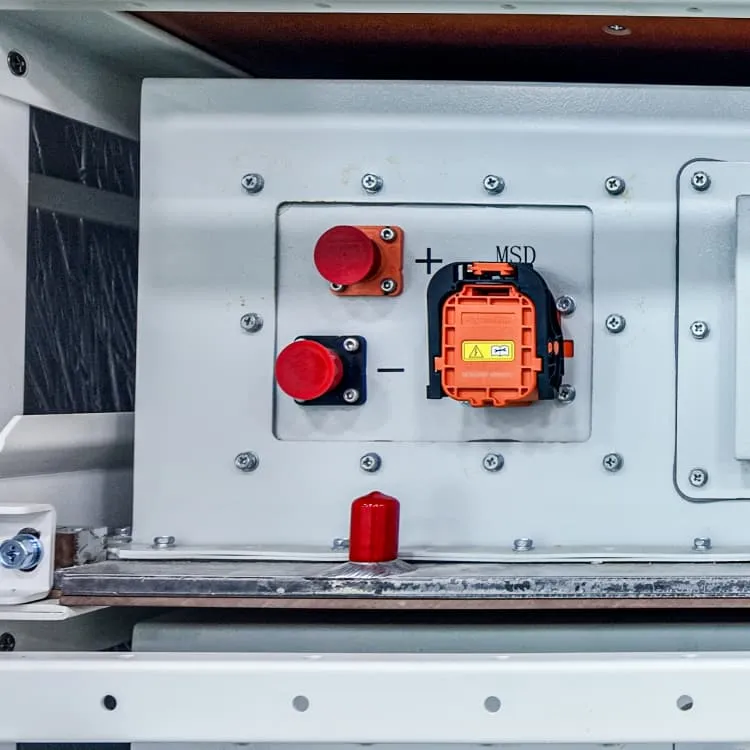

- 32650 lithium battery pack price in Yemen

- Wind solar thermal and storage integrated project

- Advantages of portable outdoor power supply

- Burundi organic photovoltaic energy storage enterprise

- Yaounde exports energy storage containers

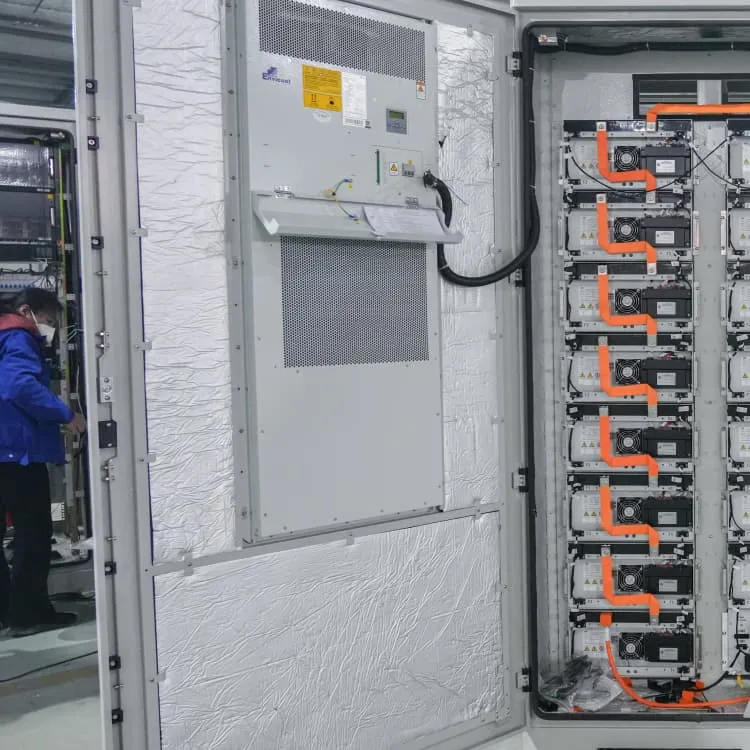

- Battery Optimization for Photovoltaic Container Systems

- Which lithium battery pack is cheaper in Abkhazia

- Oman high power outdoor power supply

- Helping communication base stations store energy and save energy

- Yemen Battery Energy Storage Price Company

- Outdoor Energy Storage Power Supply Parallel Price

- Prefabricated non-container solar power price

- 55 cell photovoltaic panel 60 difference

- Chile develops containerized energy storage

- Which power plants can store energy

- Latest prices for photovoltaic energy storage cabinets in China

- Advanced smart photovoltaic panel manufacturer