Is peak-valley arbitrage profitable in Tonga s energy storage system

How to explain energy storage valley peak arbitrage

Is a retrofitted energy storage system profitable for Energy Arbitrage? Optimising the initial state of charge factor improves arbitrage profitability by 16 %. The retrofitting scheme is profitable

How much is the peak-to-valley price difference for energy storage

When energy demands peak, storage systems release electricity back into the grid, profiting from the higher sale prices. This process of energy arbitrage relies on accurate

Arbitrage analysis for different energy storage technologies and

Energy storage systems can offer a solution for this demand-generation imbalance, while generating economic benefits through the arbitrage in terms of electricity prices

The expansion of peak-to-valley electricity price difference results

The widening of the peak-to-valley price gap has laid the foundation for the large-scale development of user-side energy storage. When the peak-to-valley spread reaches 7

ENERGY STORAGE SYSTEMS PROFITABLE THROUGH PEAK VALLEY ARBITRAGE

The prospects of energy storage in power systems Due to the fluctuating and intermittent characteristics of wind and solar power generation, the problems associated with integrating

Economic benefit evaluation model of distributed energy storage

The peak-valley arbitrage is the main profit mode of distributed energy storage system at the user side (Zhao et al., 2022). The peak-valley price ratio adopted in domestic

Energy Storage Arbitrage Under Price Uncertainty: Market Risks

We investigate the profitability and risk of energy storage arbitrage in electricity markets under price uncertainty, exploring both robust and chance-constrained optimization

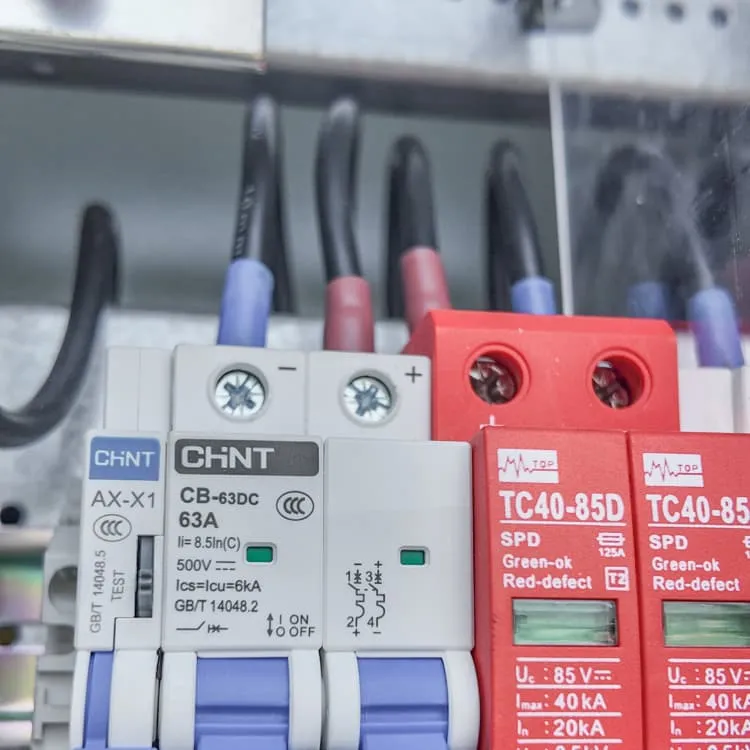

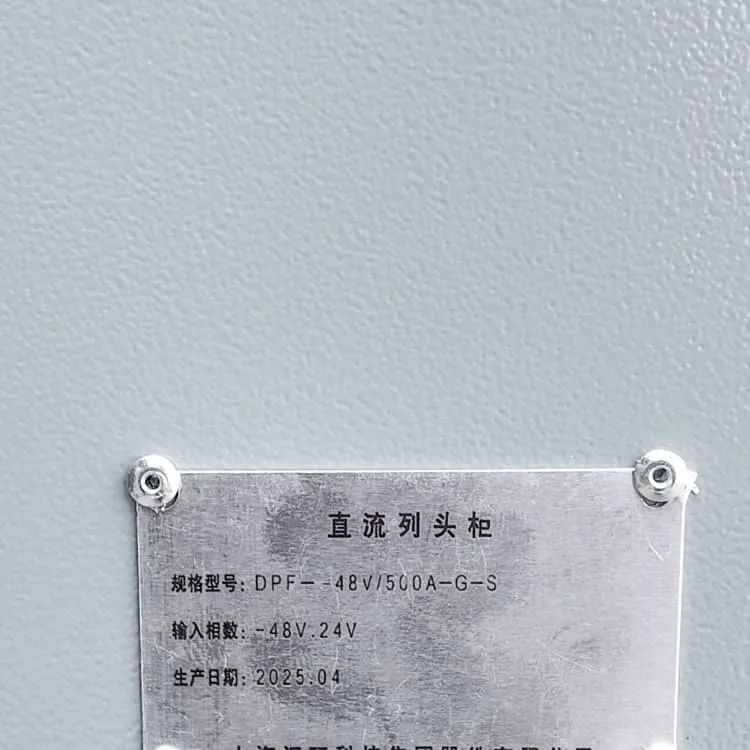

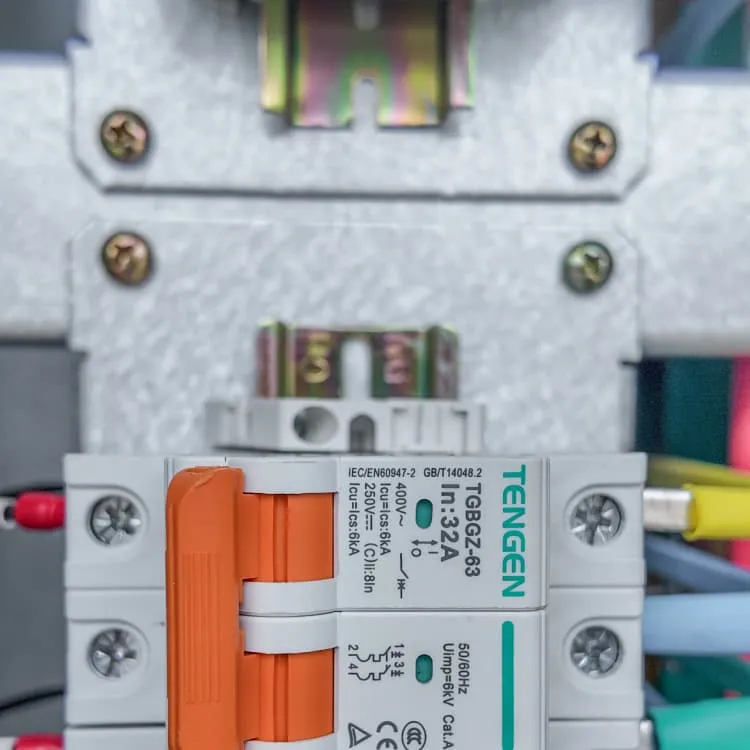

2MW/4MWh Energy Storage Project(New Materials

A smart energy storage power station system is constructed. This project builds an industrial and commercial energy storage power station on the user side with Sav''s integrated AC/DC

Peak-Valley Arbitrage: Cutting Energy Storage Costs by 40%

You know how your electricity bill suddenly spikes during heatwaves? That''s peak pricing in action. Utilities are now facing a $12 billion annual challenge globally - storing cheap off-peak

How much is the peak-to-valley price difference for energy

When energy demands peak, storage systems release electricity back into the grid, profiting from the higher sale prices. This process of energy arbitrage relies on accurate

Optimized Economic Operation Strategy for Distributed Energy Storage

In order to further improve the return rate on the investment of distributed energy storage, this paper proposes an optimized economic operation strategy of distributed energy

CAN ARBITRAGE COMPENSATE FOR ENERGY LOSSES INTRODUCED BY ENERGY STORAGE

The peak-valley arbitrage is the main profit mode of distributed energy storage system at the user side (Zhao et al., 2022). The peak-valley price ratio adopted in domestic and foreign time-of

C&I energy storage to boom as peak-to-valley spread increases

In China, C&I energy storage was not discussed as much as energy storage on the generation side due to its limited profitability, given cheaper electricity and a small peak-to

Profitability analysis and sizing-arbitrage optimisation of

Highlights • Exploring the retrofitting of coal-fired power plants as grid-side energy storage systems • Proposing a size configuration and scheduling co-optimisation framework of

Economic benefit evaluation model of distributed energy storage system

The peak-valley arbitrage is the main profit mode of distributed energy storage system at the user side (Zhao et al., 2022). The peak-valley price ratio adopted in domestic

Peak-valley arbitrage of energy storage cabinets

In scenario 2, energy storage power station profitability through peak-to-valley price differential arbitrage. The energy storage plant in Scenario 3 is profitable by providing ancillary services

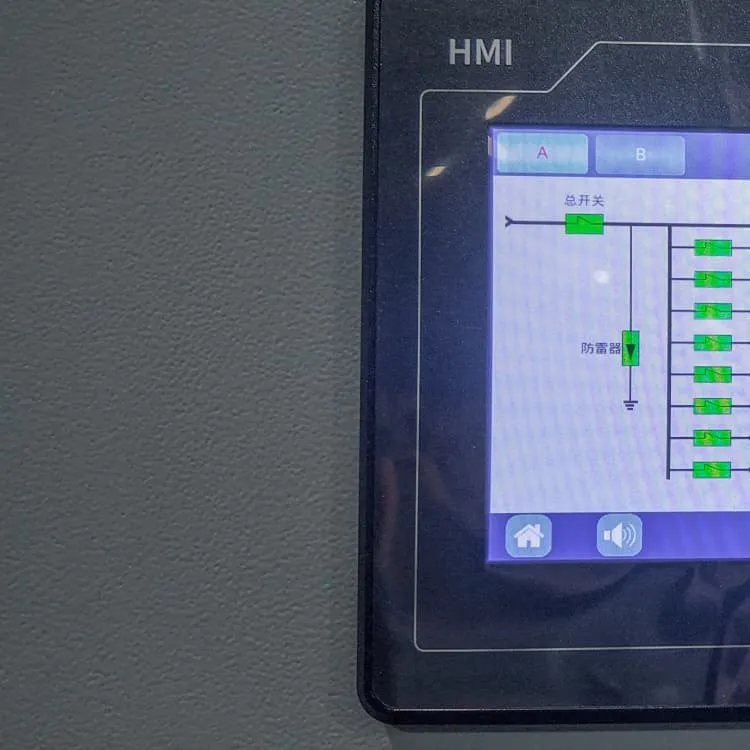

Schematic diagram of peak-valley arbitrage of energy storage.

An energy storage system transfers power and energy in both time and space dimensions and is considered as critical technique support to realize high permeability of renewable energy in

6 FAQs about [Is peak-valley arbitrage profitable in Tonga s energy storage system ]

What is Peak-Valley price arbitrage?

1. Peak-Valley Price Arbitrage Peak-valley electricity price differentials remain the core revenue driver for industrial energy storage systems. By charging during off-peak periods (low rates) and discharging during peak hours (high rates), businesses achieve direct cost savings. Key Considerations:

How energy storage systems can be used to generate arbitrage?

Due to the increased daily electricity price variations caused by the peak and off-peak demands, energy storage systems can be utilized to generate arbitrage by charging the plants during low price periods and discharging them during high price periods.

How do price differences influence arbitrage by energy storage?

Price differences due to demand variations enable arbitrage by energy storage. Maximum daily revenue through arbitrage varies with roundtrip efficiency. Revenue of arbitrage is compared to cost of energy for various storage technologies. Breakeven cost of storage is firstly calculated with different loan periods.

What are energy arbitrage battery storage strategies?

These are some of the most common energy arbitrage battery storage strategies: Time-of-Use (TOU) optimization: Relying on predictable daily price patterns, TOU optimization strategies involve charging batteries during off-peak hours and discharging them during peak hours when electricity demand is higher.

What is energy arbitrage & peak shaving?

Here, we give you a rundown of everything you need to know about energy arbitrage and peak shaving within the storage market. What is energy arbitrage? Energy arbitrage entails the purchasing of energy commodities at times of low pricing and selling it during periods of high pricing, aiming to yield profits.

How does reserve capacity affect peak-valley arbitrage income?

However, when the proportion of reserve capacity continues to increase, the increase of reactive power compensation income is not obvious and the active output of converter is limited, which reduces the income of peak-valley arbitrage and thus the overall income is decreased.

More industry information

- Lithium battery pack comes with a balancing module

- 5G communication base station EMS

- Brand new portable power bank outdoor 220

- 48v high frequency inverter to 12v inverter

- Canadian Base Station Energy Storage Company

- What are the energy storage power stations in Sudan Power Plant

- Photovoltaic inverter conversion

- Inverter 225kw stable

- Photovoltaic on-site energy solar cell cabinet

- East Asia Emergency Energy Storage Power Supply

- Malta s new energy storage policy

- Niger household energy storage lithium battery

- Mexico Group Solar Panels

- Unique features of energy storage power supply

- What are the factory prices of energy storage vehicles

- Investment cost of energy storage power station

- 2kw inverter fully loaded for 12 hours

- How many types of photovoltaic monocrystalline silicon panels are there

- Network Outdoor Base Station

- Industrial and commercial solar power collection is higher than containers

- Norway s new outdoor power supply market

- Vanadium redox flow battery types

- Mongolia Energy Storage Battery Procurement

- N-type bifacial photovoltaic modules

- 48V 2kw inverter

- Solar thermal power generation and energy storage

- Can 12V inverters be connected in parallel