Are there any subsidies for building energy storage power stations

Federal Incentives are Supercharging Energy Storage in America

Not only long-anticipated tax credits for energy storage, but also supportive state policies and continually declining costs have led to much higher expectations of storage

Financing Options For Onsite Generation, Energy Storage, and Energy

This fact sheet outlines a 6-step process to help organizations select a financing mechanism for onsite energy generation, storage, and/or energy efficiency projects.

Are there any subsidies for energy storage batteries

The goal is to add 200 MW in combined capacity with at least 100 MW of battery energy storage supported by subsidies. Participants are competing for EUR 55 million. Maximum support per

2025 Energy Storage Power Station Subsidy Policy: What You

That''s essentially what the 2025 subsidy policy does for energy storage. But instead of caffeine fixes, we''re talking tax credits, cash grants, and capacity-based incentives.

US Policies & Incentives for Home Energy Storage | FranklinWH

Here is a breakdown of the most significant policies and incentives for home energy storage in the United States. The federal government offers as high as a 30% tax credit

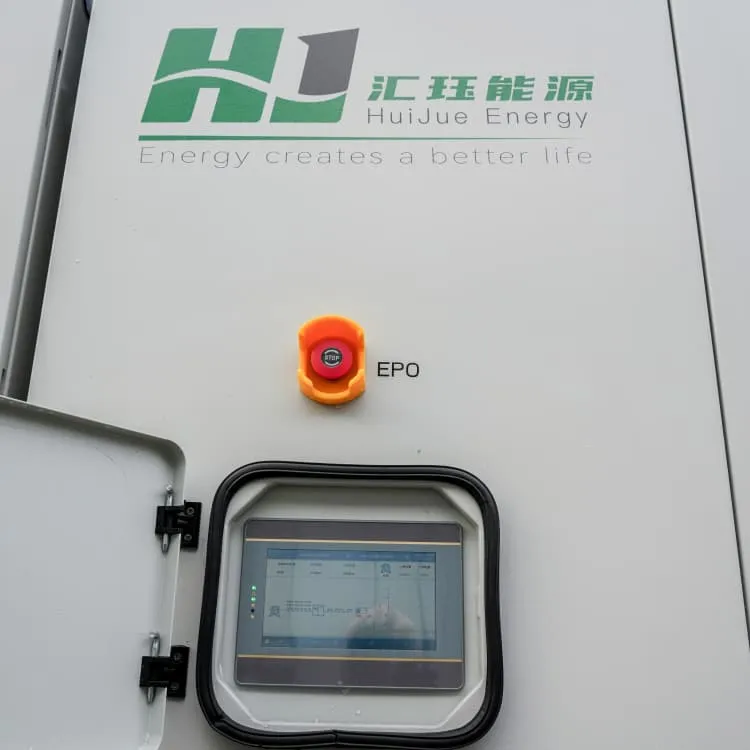

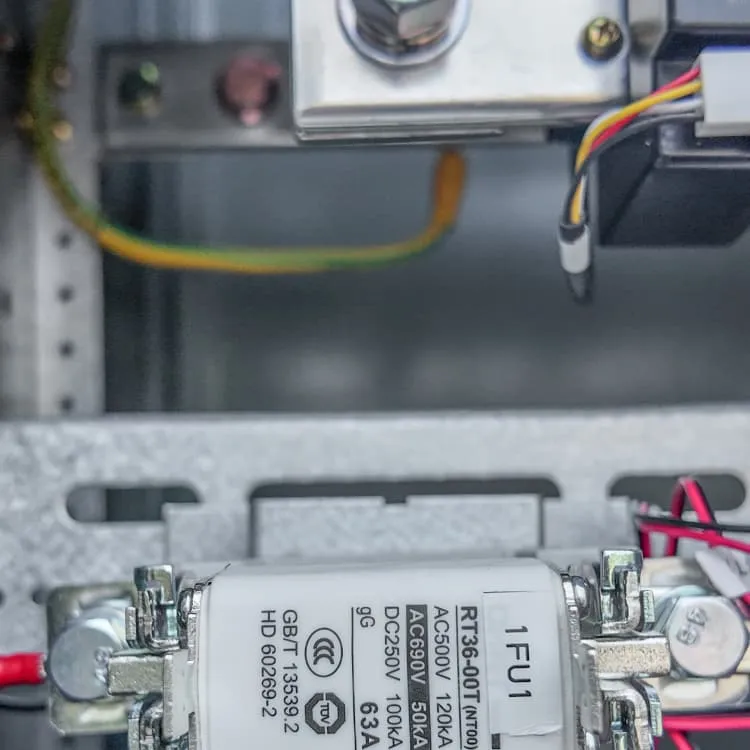

Building an Energy Storage Power Station: Key Considerations

Why Energy Storage Stations Are the New Rock Stars of Clean Energy Let''s face it – if renewable energy were a rock band, energy storage power stations would be the drummer keeping the

US Policies & Incentives for Home Energy Storage | FranklinWH

That''s essentially what the 2025 subsidy policy does for energy storage. But instead of caffeine fixes, we''re talking tax credits, cash grants, and capacity-based incentives.

The latest subsidies and policies for energy storage companies

EUR 9.6 million in subsidies for renewable energy storage Estonian Ministry of Economy will provide EUR 9.6 million to companies producing energy from renewable sources to invest in

What the budget bill means for energy storage tax credit eligibility

Storage projects that start construction before 2033 will remain eligible for both the ITC and PTC. Those beginning in 2025 can receive an ITC of up to 50% under 48E if domestic

How much is the financial subsidy for energy storage power stations

The financial subsidies allocated for energy storage power stations have far-reaching economic implications. By lowering installation costs and stimulating technological

State Planning and Funding for Electric Vehicle Charging

Visit the U.S. Department of Energy''s (DOE) IIJA Programs for a review of new DOE programs. The Federal and State Laws and Incentives database is another resource for federal and state

What subsidies are there for energy storage power stations?

In summary, the subsidies available for energy storage power stations significantly contribute to the advancement of this vital technology. Financial incentives like direct funding,

4 FAQs about [Are there any subsidies for building energy storage power stations ]

What is an energy subsidy?

An energy subsidy is an inefficient but administratively easy way to favor or pay off friends and supporters. Energy subsidies are often the only government favor or good that politicians can credibly promise to provide to voters and other supporters.

How will the obbb impact residential battery owners?

Wannabe residential battery owners will likely feel the most immediate impact of the OBBB. Updates to the 25D residential solar tax credit, which covers solar panels, solar water heaters and related property like home battery storage systems, have significantly shortened the timeline for homeowners to access the credit.

Are residential batteries a good investment?

While storage fared better than solar and wind, homeowners interested in residential batteries face dwindling opportunities. A solid-state battery co-created by the Pacific Northwest National Laboratory and Ampcera, Inc. Image: Andrea Sarr, Pacific Northwest National Laboratory

Do home batteries qualify for tax credits?

Now, home batteries will only qualify for the 30% tax credit if they’re purchased and installed by the end of the year before the credit phases out entirely. There is a bright spot: residential systems leased from third parties will remain eligible for tax credits beyond 2025, as they rely on 48E instead of 25D.

More industry information

- Can solar refraction photovoltaic panels generate electricity

- Jamaica lithium energy storage power manufacturer

- Brunei BESS Telecom Energy Storage Container

- Mobile power station power generation price

- Solar on-site energy without solar panels

- Fire safety of energy storage batteries

- Solid-state lithium battery as outdoor power supply

- Special Energy Storage Vehicle Product Introduction

- Equivalent charge and discharge times of energy storage power station

- Barbados installs charging pile energy storage cabinets

- Wind Energy Storage Project

- Huawei Czech portable power bank

- How a solar on-site energy network provides

- Brunei Communication Base Station Energy Storage System Foundation Construction

- Battery cabinet cost improvement

- Armenia Wind Solar and Energy Storage Project

- Distributed Energy Storage Management in the Solomon Islands

- South Ossetia outdoor battery cabinet BMS function

- Solar energy charging display load

- Marshall Islands outdoor energy storage vehicle manufacturer

- What is an energy storage substation

- Peru 5G communication base station inverter grid connection requirements

- How big an inverter can I use for 24 volts 40a

- Icelandic energy storage container design

- Flexible photovoltaic panel companies

- Malawi 5G communication base station photovoltaic

- Is flywheel energy storage the most advanced