Is the battery cabinet considered a fixed asset

Would you capitalize a machine battery? : r/Accounting

I''ve reviewed AS-10 and I''m conflicted as to whether or not the batteries should be capitalized. They do not increase the revenue producing capabilities of the machine, but I''m not sure if

Proper Classification of Fixed Assets in Financial Statements

The two main classifications of fixed assets are current assets and non-current assets. Current assets are not depreciated and non-current assets are depreciated over their useful life.

9 General Categories of Fixed Assets (With Explanation)

Fixed assets are classified differently than current assets on a balance sheet. Current assets refer to assets that are either expected to be converted into cash or consumed within one year or

INTEGER WEALTH FINANCE What Items Are Included in

Date: 05 July 2021 Fixed assets are long-term investments in the operation of a company. Unlike current assets, which are easily converted to cash, fixed assets provide value over a period of

Alert: Is Your Car Battery a Fixed Asset That Could Cost You?

Based on accounting principles, industry practices, and regulatory considerations, a car battery is generally classified as a fixed asset. This classification has implications for

The proper classification of fixed assets — AccountingTools

The furniture and fixtures account is one of the broadest categories of fixed assets, since it can include such diverse assets as warehouse storage racks, office cubicles, and desks.

Fixed Assets In The Balance Sheet: Classification, Recognition

Property, plant, and equipment are non-current physical assets of a business operating the business and keeping it running. Classification Of Fixed Assets As discussed above, the fixed

Electrical Improvements Depreciation Life: How to Classify and

These are typically associated with acquiring or improving long-term assets, such as electrical systems that enhance a property''s value or extend its life. Installing a new

Fixed Asset or Expense? Decoding the IRS Rule

According to IRS Publication 946, an item should be considered a capital expense (or fixed asset) if it meets the following conditions: It has a useful life that extends beyond the current year or

Furniture and fixtures definition — AccountingTools (2025)

Furniture and fixtures are larger items of movable equipment that are used to furnish an office. Examples are bookcases, chairs, desks, filing cabinets, and tables. This is a

6 FAQs about [Is the battery cabinet considered a fixed asset ]

What is a fixed asset?

Unlike current assets, which are easily converted to cash, fixed assets provide value over a period of years and are not likely to be liquidated in the upcoming year. Examples of fixed costs include buildings, computers, manufacturing equipment, vehicles, office equipment and furniture.

Is equipment a fixed asset?

Equipment is classified as a fixed asset in accounting. Fixed assets are long-term investments used for business operations and not intended for resale. This classification distinguishes equipment from short-term assets like supplies or inventory. Is Equipment an Expense? Equipment is not considered a direct expense in the year of purchase.

How are fixed assets classified on a balance sheet?

Fixed assets are classified differently than current assets on a balance sheet. Current assets refer to assets that are either expected to be converted into cash or consumed within one year or the operating cycle of the business, whichever is longer.

Is a computer a fixed asset?

The computers, with an expected useful life of more than a year, were categorized as fixed assets and depreciated over five years. The software packages, which had a one-year license, were considered expenses and deducted in full in the current year.

Is a new vehicle a fixed asset?

In simple terms, fixed assets are items that have a life span of one year or longer. Cash in the business current account would not be a fixed asset because you're going to use it up within the next 12 months. A new vehicle, by contrast, is a fixed asset because you're going to get three, five or more years of use from it.

Can a business expense a fixed asset?

Under Section 179 of the IRS code, businesses can elect to expense the cost of a fixed asset in the year of purchase, subject to certain limits and restrictions. Your Turn: Fixed Asset or Expense?

More industry information

- Kazakhstan solar panel inverter

- San Marino emergency outdoor power supply brand

- Small and medium-sized wind power generation systems in Guatemala

- Sudan s solar power generation

- 5g base station cabinet manufacturer

- Gabon communication base station power supply

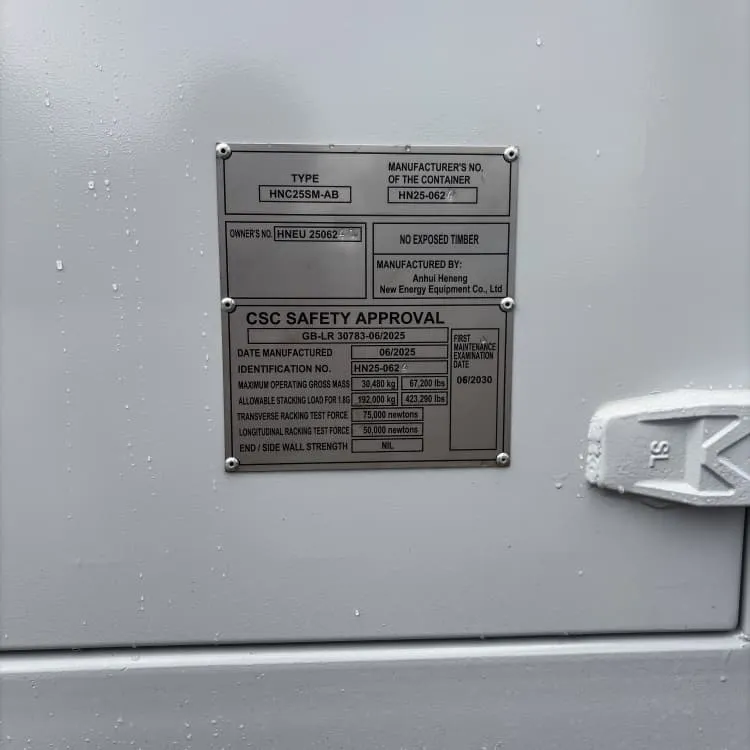

- Croatia electrical container energy storage

- Small solar systems in South Ossetia

- Mauritius specializes in the production of photovoltaic inverters

- How to connect the power supply of the energy storage cabinet base station

- Is the wind solar and energy storage integrated project reliable

- Solar self-organizing network fixed base station

- American photovoltaic inverter manufacturing company

- Photovoltaic energy storage charging piles are profitable

- Home solar all-in-one machine parameters

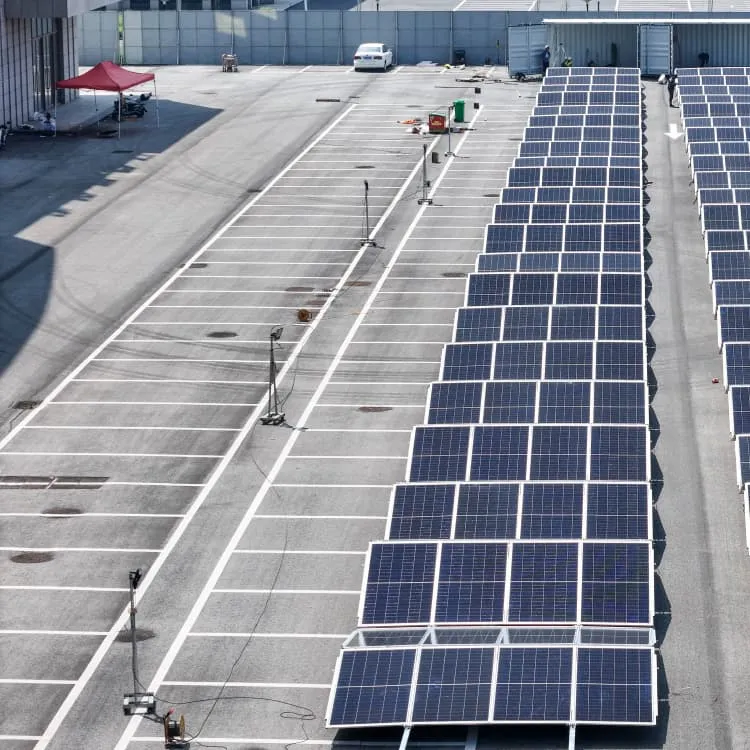

- Photovoltaic plant placing solar panels

- Where to go for outdoor communication power supply BESS

- Island battery cabinet price

- Benin Energy Storage Container Cooling System

- Bulgarian hydropower energy storage project

- 50kw three-phase energy storage inverter

- Is someone going to build a communication base station battery

- How many watts does a 12v 60AH inverter match

- Can a 60v inverter use a 12v lithium battery

- Battery Cabinet Battery Installation Requirements

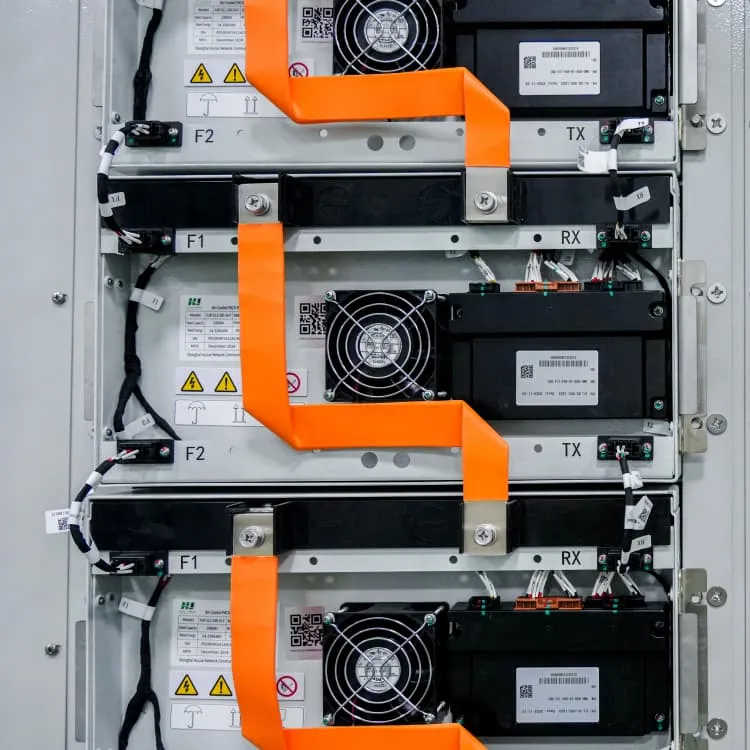

- 5g base station equipment power supply types include

- Huawei Distributed Energy Storage in Georgia